Renters Insurance in and around Honolulu

Looking for renters insurance in Honolulu?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a house or a townhome, protection for your personal belongings is beneficial, even if your landlord doesn’t require it.

Looking for renters insurance in Honolulu?

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented apartment include a wide variety of things like your TV, couch, cooking set, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Ross Tsuha has the dedication and personal attention needed to help you examine your needs and help you insure your precious valuables.

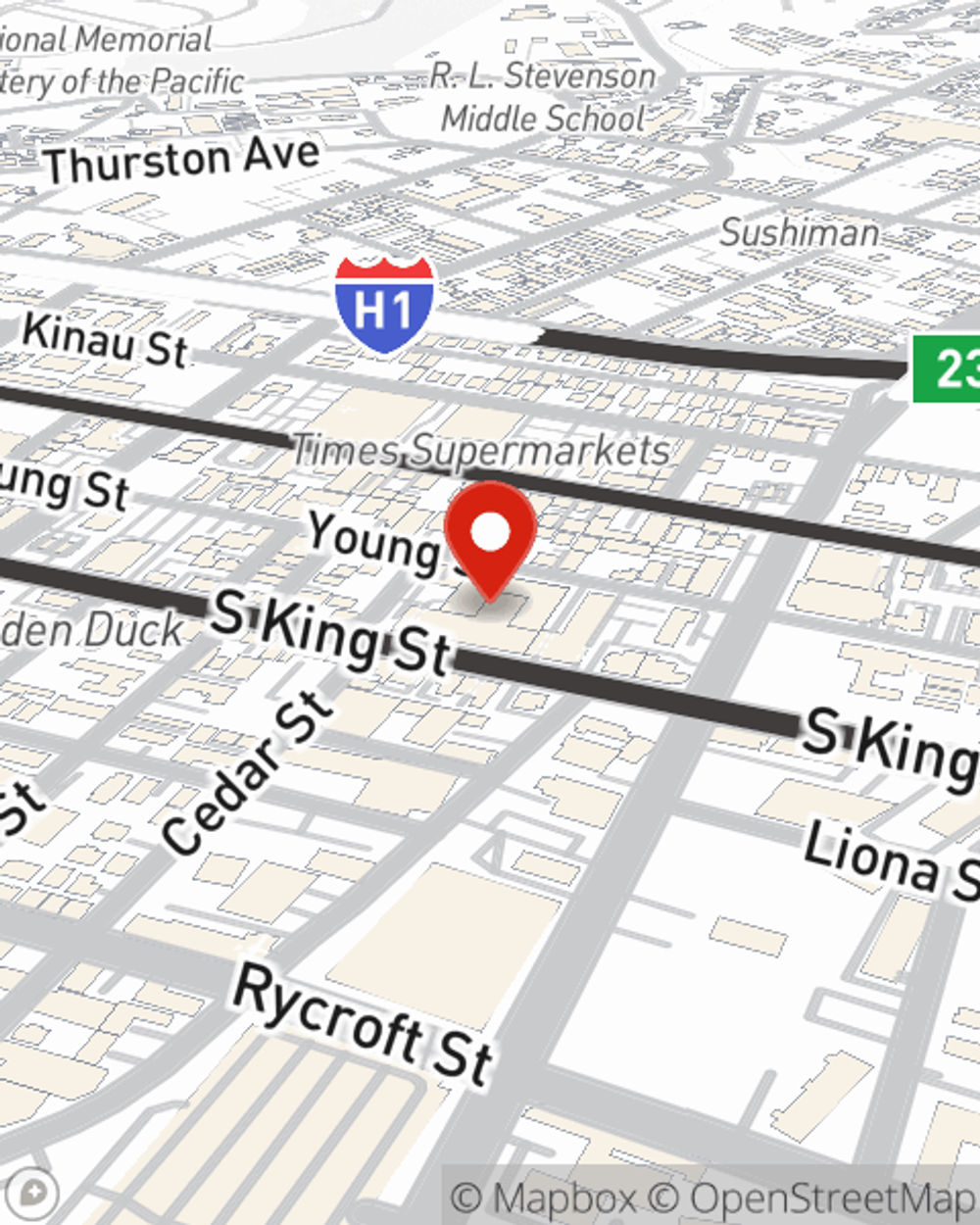

Renters of Honolulu, reach out to Ross Tsuha's office to learn more about your particular options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Ross at (808) 545-4116 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.